TFSA invest

For newcomers to Canada are looking to invest in their financial future, the Tax-Free Savings Account (TFSA) offers an incredible opportunity. This investment account allows you to grow your wealth without the burden of paying taxes on your earnings.

Similar to a Roth IRA in the U.S., contributions to a TFSA are made with after-tax dollars—meaning you won’t get a tax deduction upfront. However, the real advantage comes from the fact that all investment gains and future withdrawals are completely tax-free. It’s a powerful way to make the most of your investments while keeping your hard-earned money working for you!

Table of Contents

Why Open a TFSA?

A Tax-Free Savings Account (TFSA) can be a game-changer for your financial future, offering substantial savings on income taxes over your lifetime. Consider this example:

Imagine Martha starts with a $7,000 contribution to her TFSA in 2024. She continues to invest $7,000 annually until 2065 and earns an average annual compounded return of 6%. By the end of this period, her investment would grow to a remarkable $868,333.78.

With a 30% marginal income tax rate, Martha could potentially save $260,500.13 in taxes—assuming the income is from interest. This illustrates the immense potential for tax savings and wealth accumulation a TFSA provides.

Who Can invest ?

Any Canadian resident who is 18 or older and has a valid Social Insurance Number (SIN) is eligible to open a TFSA. Whether you’re a temporary resident, on a work or study permit, a permanent resident, or a Canadian citizen, as long as you meet the residency requirement for tax purposes, you can benefit from a TFSA.

How Much Can You invest ?

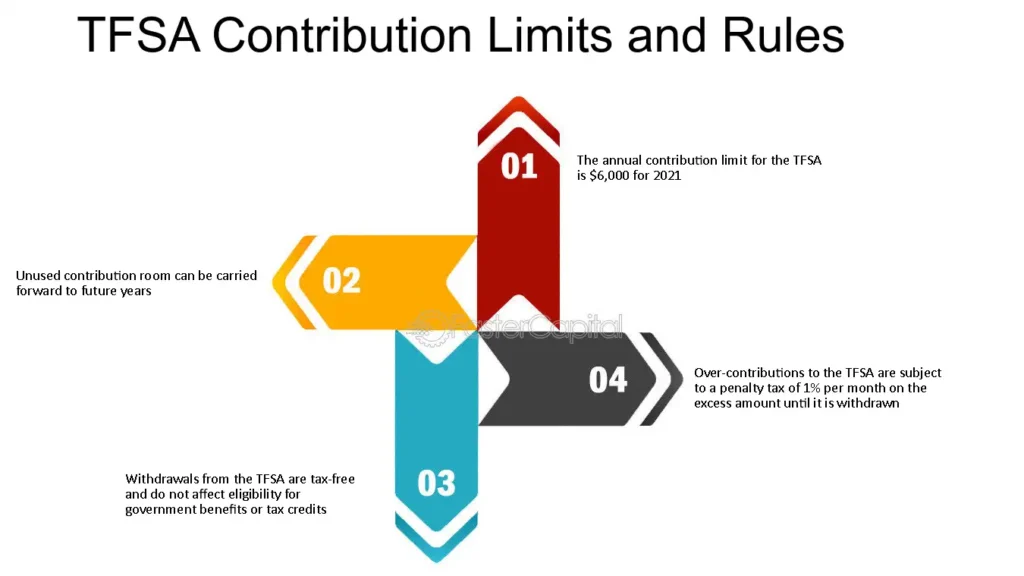

TFSA contribution room accumulates for each year you are 18 or older and a Canadian resident. For 2024, the annual contribution limit is set at $7,000. This limit, which started at $5,000 in 2009, is adjusted for inflation and rounded to the nearest $500, ensuring that your savings potential keeps pace with economic changes.

Maximizing Your TFSA: What You Need to Know

Accumulating Contribution Room

If you turned 18 in 2009 and have been a resident of Canada since then, you would have accumulated the maximum TFSA contribution room of $95,000. This generous limit allows for significant tax-free growth over the years.

Flexibility and Tracking Your investment

TFSA holders enjoy the flexibility to withdraw funds at any time without paying taxes on those withdrawals. Plus, any amount withdrawn is added back to your contribution room for the following year.

However, exceeding your contribution limit can result in a costly penalty. The Canada Revenue Agency (CRA) imposes a 1% monthly tax on excess contributions until they are withdrawn. For instance, if George, who turns 18 in 2024, contributes $8,000 to his TFSA and exceeds his limit by $1,000, he will incur a penalty of $30 if he corrects it after three months ($1,000 x 1% x 3).

To avoid this, you can check your contribution limits on your CRA My Account. Keep in mind, these figures might lag by a year, so maintaining accurate personal records is crucial to avoid penalties.

Investing Within Your TFSA

While the term “savings” in TFSA might suggest a simple savings account, it’s much more versatile. Many use TFSAs for holding cash, but they are ideally suited for long-term investments like exchange-traded funds (ETFs), mutual funds, guaranteed investment certificates (GICs), stocks, and bonds. The real benefits of a TFSA come when you invest in higher-yielding assets, optimizing your tax-free growth.

What Happens If You Become a Non-Resident?

If you move out of Canada, you can retain your TFSA without facing Canadian taxes on investment income or withdrawals. However, you won’t accrue additional contribution room for the years you’re a non-resident. Withdrawals will still increase your contribution room for the following year, but you can only use this room if you return to Canadian residency. Be cautious about contributing while a non-resident, as these contributions will be taxed at 1% per month.

Determining Canadian Residency

To verify your residency status, consult the Income Tax Folio: S5-F1-C1, or contact the CRA at 1-800-959-8281 (within Canada and the U.S.) or 613-940-8495 (internationally).

Where to Open a TFSA

Almost all Canadian financial institutions offer TFSA options. Choose one that aligns with your investment goals and needs.

What Happens Upon Death?

If a TFSA holder passes away, the account can be transferred to a spouse or common-law partner as a successor holder. The successor will enjoy the same tax-free benefits on earnings and withdrawals, continuing the tax-efficient legacy of the TFSA.

Get in touch now with Esse india immigration for more information.